Somos la solución integral a su empresa y hacemos realidad sus proyectos dentro de los Estados Unidos. www.200gfs.com Two Hundred Global Financial Solutions es: Contabilidad, Taxes, Nuevas Empresas, EIN, ITIN, Registro de Marca Comercial, Notaria Publica, Informes Económicos y Proyectos, Real Estate y mucho más. Oficinas en Florida USA. Artículos en Español y en Inglés. 12555 ORANGE DR., STE. 235, DAVIE, FL 33330, USA.

miércoles, 31 de mayo de 2023

martes, 30 de mayo de 2023

Las tasas de interés se mantienen para el tercer trimestre de 2023

IR-2023-104, May 22, 2023

WASHINGTON — The Internal Revenue Service today announced that interest rates will remain the same for the calendar quarter beginning July 1, 2023.

For individuals, the rate for overpayments and underpayments will be 7% per year, compounded daily. Here is a complete list of the new rates:

- 7% for overpayments (payments made in excess of the amount owed), 6% for corporations.

- 4.5% for the portion of a corporate overpayment exceeding $10,000.

- 7% for underpayments (taxes owed but not fully paid).

- 9% for large corporate underpayments.

Under the Internal Revenue Code, the rate of interest is determined on a quarterly basis. For taxpayers other than corporations, the overpayment and underpayment rate is the federal short-term rate plus 3 percentage points.

Generally, in the case of a corporation, the underpayment rate is the federal short-term rate plus 3 percentage points, and the overpayment rate is the federal short-term rate plus 2 percentage points. The rate for large corporate underpayments is the federal short-term rate plus 5 percentage points. The rate on the portion of a corporate overpayment of tax exceeding $10,000 for a taxable period is the federal short-term rate plus one-half (0.5) of a percentage point.

The interest rates announced today are computed from the federal short-term rate determined during April 2023. See the revenue ruling for details.

lunes, 29 de mayo de 2023

Memorial Day

Te ayudamos y acompañamos a realizar tu sueno en los Estados Unidos. Te abrimos tu empresa.

Te ayudamos y acompañamos a realizar tu sueno en los Estados Unidos. Te abrimos tu empresa.

viernes, 26 de mayo de 2023

Número de identificación personal del contribuyente del IRS (ITIN) - Nosotros somos CAA

Two Hundred Global Financial Solutions, es CAA ante el IRS para tramitar tu ITIN Number.

Desde donde estés consúltanos que hacer si necesitas uno, lo tienes vencido o cualquier otra consulta a:

email: info@200gfs.com

o nuestra pagina: www.200gfs.com

Tomado de la pagina del IRS

Te ayudamos y acompañamos a realizar tu sueno en los Estados Unidos. Te abrimos tu empresa.

Te ayudamos y acompañamos a realizar tu sueno en los Estados Unidos. Te abrimos tu empresa.

jueves, 25 de mayo de 2023

Preparativos para la temporada de huracanes 2023: Cómo organizar tus finanzas

martes, 23 de mayo de 2023

Un PIN de Protección de Identidad ayuda a proteger a los contribuyentes del robo de identidad relacionado con los impuestos

Los PIN de protección de identidad evitan que los ladrones de identidad presenten declaraciones de impuestos fraudulentas. A los contribuyentes que participan en este programa se les asigna un número de seis dígitos que utilizan para comprobar su identidad cuando presentan su declaración de impuestos federales. El PIN de protección de identidad del IRS es una capa adicional de seguridad para los contribuyentes. En el pasado reciente, el Comité Asesor de Administración Tributaria Electrónica llamó al IP PIN, " La herramienta de seguridad número uno actualmente disponible para los contribuyentes del IRS".

Cómo solicitar un IP PIN

Después de que un contribuyente verifique su identidad, la herramienta Obtenga un PIN de IP permite que las personas con un número de Seguro Social o un número de identificación de contribuyente individual soliciten un PIN de IP en línea. Los contribuyentes deben revisar los requisitos de verificación de identidad antes de intentar utilizar la herramienta Obtener un PIN de IP.

Los profesionales de impuestos deben aconsejar a los clientes afectados por el robo de identidad que soliciten un IP PIN. Incluso si un ladrón ya ha presentado una declaración de impuestos fraudulenta, un IP PIN podría evitar que el contribuyente sea una víctima repetida del robo de identidad relacionado con los impuestos.

Información adicional sobre IP PIN

- Un IP PIN es válido por un año. Por razones de seguridad, cada año se generan nuevos IP PIN. Algunos participantes recibirán su PIN de IP por correo, mientras que otros tendrán que iniciar sesión en la herramienta Obtener un PIN de IP para ver su PIN de IP actual.

- Los contribuyentes inscritos pueden volver a iniciar sesión en la herramienta Obtener un PIN de IP para ver su PIN de IP actual.

- Los contribuyentes con un IP PIN deben usarlo al presentar cualquier declaración de impuestos federales durante el año, incluidas las declaraciones de impuestos del año anterior o las declaraciones enmendadas.

- Los usuarios de IP PIN deben compartir su número solo con el IRS y su proveedor de preparación de impuestos. El IRS nunca llamará, enviará un correo electrónico ni enviará un mensaje de texto para solicitar el IP PIN .

- Los contribuyentes pueden obtener un IP PIN ahora para 2023. El IRS emitirá nuevos IP PIN a partir de enero de 2024.

Los contribuyentes que no pueden validar su identidad en línea aún pueden obtener un IP PIN

Los contribuyentes que no puedan validar su identidad en línea y cuyos ingresos estén por debajo de cierto umbral pueden presentar el Modelo 15227, Solicitud de Número de Identificación Personal de Protección de Identidad . El umbral para 2023 es de $73,000 para individuos o $146,000 para casados que presentan una declaración conjunta.

Una vez que el IRS reciba el formulario, un representante llamará al contribuyente al número de teléfono que proporcionó para validar su identidad. Una vez verificado, el contribuyente recibirá un IP PIN por correo, generalmente dentro de cuatro a seis semanas.

Los contribuyentes que no puedan validar su identidad en línea o por teléfono, que no cumplan con los requisitos para presentar un Formulario 15227, o que tengan dificultades técnicas, pueden hacer una cita en un Centro de Atención al Contribuyente . Deberán traer una identificación con foto emitida por el gobierno actual y otro documento de identificación para probar su identidad. Una vez verificado, el contribuyente recibirá un IP PIN por correo, generalmente dentro de las tres semanas.

lunes, 22 de mayo de 2023

TSA is prepared for high travel volumes this Memorial Day weekend and the summer travel season

FOR IMMEDIATE RELEASE May 22, 2023

TSA is prepared for high travel volumes this Memorial Day weekend and the summer travel season

Agency announces new benefit to TSA PreCheck® membership and continues to deploy checkpoint technology to improve security effectiveness, efficiency and the passenger experience

WASHINGTON — The Transportation Security Administration (TSA) is prepared to screen high volumes of passengers at airport security checkpoints nationwide this summer travel season, which begins Memorial Day weekend and runs through Labor Day. The agency forecasts Friday, May 26, to be the busiest day of the long weekend, projecting to screen approximately 2.6 million passengers.

Today, the agency announced that teenagers aged 13-17 may now accompany TSA PreCheck® enrolled parents or guardians through TSA PreCheck screening when traveling on the same reservation and when the TSA PreCheck indicator appears on the teen’s boarding pass. Children 12 and under may still accompany an enrolled parent or guardian when traveling through the TSA PreCheck lanes anytime without restriction.

“TSA is ready to handle this summer’s anticipated increase in travel. Our staffing levels are better and this is largely due to better pay for all TSA employees which starts on July 1st,” said TSA Administrator David Pekoske. “This key action, supported by the President and Congress, enables us, for the first time in TSA’s history, to pay our workforce using the same pay scale that applies to other federal employees. As expected, this has already improved our recruiting and retention rates. For passengers, this will mean better overall staffing for all of TSA’s activities that support secure and efficient travel and an improved passenger experience. Our strong partnerships with airports and airlines will ensure we are able to anticipate and respond to changes in passenger travel throughout the summer. Passengers can help as well by being prepared, by having their identification ready when they begin screening and checking to make sure they aren’t bringing firearms, oversized liquids or any other prohibited item into the checkpoint. One person’s actions can delay screening for everyone else.”

Earlier today at a press conference at Hartsfield-Jackson Atlanta International Airport (ATL), Atlanta Mayor Andre Dickens and six airport and airline partners joined Pekoske to discuss their operational preparedness for anticipated summer travel volumes, changes in transportation security and other travel tips. Industry representatives included Jan Lennon, Hartsfield-Jackson Atlanta International Airport Deputy General Manager for Operations; Nicholas E. Calio, President and CEO, Airlines for America; Kevin M. Burke, President and CEO, Airports Council International – North America; Stephanie K. Gupta, Senior Vice President, Security and Facilitation, American Association of Airport Executives; Paul Doell, Vice President of Government Affairs and Security Policy, National Air Carrier Association; and Drew Jacoby Lemos, Vice President of Government and External Affairs for the Regional Airline Association.

To continue to modernize airport checkpoints, enhance security effectiveness and efficiency and improve the passenger experience, TSA is deploying new technology solutions nationwide. Credential Authentication Technology (CAT) units confirm the authenticity of a passenger’s identification credentials, along with their flight details and pre-screening status (such as TSA PreCheck) all without a boarding pass. With CAT, passengers only need to provide their acceptable photo identification to the officer. The second generation of CAT, also called CAT-2, in use at several airports nationwide, has the same capabilities, but is also equipped with a camera that captures a real-time photo of the traveler at the Travel Document Checker podium. CAT-2 compares the traveler’s photo on the identification credential against the in-person, real-time photo. Once the CAT-2 confirms the match, a TSA officer will verify and the traveler can proceed to security screening, without ever exchanging a boarding pass. TSA officers may perform additional passenger verification if needed. Photos captured by CAT units are never stored or used for any other purpose than immediate identity verification. Travelers who do not wish to participate in the facial matching process may opt out in favor of an alternative identity verification process without losing their place in line. TSA is committed to protecting passenger privacy, civil rights, civil liberties and ensuring the public’s trust as it seeks to improve the passenger experience through its exploration of identity verification technologies.

To date, TSA has deployed 2,054 CAT units to 223 airports. Among those, 238 CAT units represent the second generation (CAT-2) technology. Additionally, Georgia is the latest state to launch its mobile driver’s license (mDL). TSA is able to read the following digital IDs: Arizona, Colorado, Georgia and Maryland mDLs provisioned to Apple Wallet, Utah mDLs stored in the GET Mobile ID app and American Airlines digital ID stored in the Airside Digital Identity app.

TSA is also deploying new state-of-the-art Computed Tomography (CT) units to checkpoints nationwide, which significantly improves scanning and threat detection capabilities for carry-on bags. CT units give TSA officers the ability to review a 3D image of passengers’ bags and reduce the need to physically search the contents of the bag. Passengers screened in security lanes with CT units do not need to remove their 3-1-1 liquids or laptops, but they must place every carry-on item, including bags, into a bin for screening. TSA has also deployed 678 CT units to 218 airports nationwide. In April, the agency announced awards for the procurement and maintenance of additional CT scanners and CAT-2 units for installments at security checkpoints starting this summer.

Based on some of the most recent trends at the nation’s airports, TSA recommends the following seven simple tips to get through the TSA security checkpoint quickly and efficiently:

Tip 1: TSA PreCheck® members: Make sure your Known Traveler Number (KTN) is in your reservation. With over 15 million TSA PreCheck members, it is essential that airline reservations have the passenger’s correct KTN and date of birth so they can truly “Travel with Ease.” Those who fly with multiple airlines should ensure their KTN is updated in each of their airline profiles every time they travel. TSA PreCheck passengers are low-risk travelers who do not need to remove shoes, belts, liquids, food, laptops and light jackets at the TSA checkpoint.

If you aren’t yet enrolled in TSA PreCheck and appreciate faster checkpoint screening, we encourage you to enroll for a five-year membership at a cost of $78. Most new enrollees receive their KTN within three to five days. Members may renew membership online up to six months prior to expiration for another five-year term for $70.

In April, 94% of TSA PreCheck passengers waited less than 5 minutes at the checkpoint. TSA’s wait time standards for TSA PreCheck lanes are under 10 minutes and under 30 minutes for standard lanes.

Tip 2: Pack an empty bag and know before you go. When airline passengers begin packing for travel with an empty bag, they are less likely to be stopped at the security checkpoint for having prohibited items. Prior to packing that empty bag, check TSA’s “What Can I Bring?” tool to know what is prohibited. Firearms are prohibited at airport security checkpoints and on board aircraft. Passengers may travel with a firearm if they properly pack the firearm in checked baggage and declare it with the airline at check-in. Airlines may have additional requirements for traveling with firearms and ammunition, so travelers must also contact their airline regarding firearm and ammunition carriage policies prior to arriving at the airport. If passengers bring a firearm to the security checkpoint, they will face significant penalties to include federal penalties and additional screening.

Tip 3: Give yourself plenty of time. Summer travel will be busy, so plan ahead! Give yourself plenty of time to park or return a rental car, take a shuttle to the airport if needed, check-in with your airline, check in bags with the airline and prepare for the security checkpoint. Save time by removing items from pockets and placing them in your carry-on bag, instead of putting items directly into bins at the conveyor belt.

Tip 4: Be aware of new checkpoint technology and follow guidance from our TSA officers. TSA uses a variety of security methods to secure our transportation systems. Screening protocols can be unpredictable and may vary from airport to airport depending on available technology and the current threat environment, so it is important to listen and follow officer directions. Some airports may have installed the new state-of-the-art advanced technology CT scanners. The opening to the X-ray tunnel on a CT unit is slightly smaller than on a traditional X-ray unit so TSA advises travelers not to force larger items into the tunnel, but to ask a TSA officer for assistance. Passengers must also place everything, including bags, into the bin for screening. Passengers are also reminded to bring at maximum one carry-on bag and one personal item through security screening. Some airports have construction underway to install these new CT scanners, and TSA asks passengers to be patient during the screening process.

Before passengers go through the AIT, all items such as wallets, cell phones and all light outerwear must be removed. Light outerwear is defined as an outer layer of clothing with a full front zipper or buttons used to fasten the outer garment, excluding button up shirts. Examples include, but are not limited to, windbreakers and vests, suit/sport coats, blazers and light jackets.

Tip 5: Respect TSA and other frontline airport and airline employees. Violence and unruly behavior in the nation’s transportation system are not acceptable and results in delays at traveler checkpoints. TSA officers, along with all frontline airport and airline employees and local law enforcement are all working together to ensure safe and secure travel. Assaulting a TSA officer is a federal offense and will result in penalties and/or arrest. Always follow the directions of flight attendants aboard aircraft. They are there for your safety and security.

Tip 6: Make sure you have an acceptable ID. Adult passengers 18 years and older must show valid identification at the airport checkpoint in order to travel. Beginning May 7, 2025, if you plan to use your state-issued ID or license to fly within the U.S., make sure it is REAL ID compliant. If you are not sure if your ID complies with REAL ID, check with your state department of motor vehicles. For questions on acceptable IDs, go to TSA.gov.

Tip 7: Contact TSA with questions, compliments, complaints or assistance. Travelers with questions have many options for contacting TSA. AskTSA is available for live assistance from 8 a.m. until 6 p.m. ET via Twitter or Facebook by messaging @AskTSA or by sending a text to “272872” (“AskTSA”). For customer service issues, travelers may reach the TSA Contact Center (TCC) at (866) 289-9673. Individuals with disabilities, medical needs or other special circumstances may request passenger assistance at least 72 hours in advance by contacting our TSA Cares passenger support line at (855) 787-2227. Live assistance for both the TCC and TSA Cares is available weekdays, 8 a.m. to 11 p.m. ET, or weekends and holidays from 9 a.m. to 8 p.m. ET.

For those traveling with children this summer, TSA offers kid-friendly videos for children packing for their upcoming trip.

Te ayudamos y acompañamos a realizar tu sueno en los Estados Unidos. Te abrimos tu empresa.

Te ayudamos y acompañamos a realizar tu sueno en los Estados Unidos. Te abrimos tu empresa.

FINANZAS Y ALGO MAS...NUEVA LEY DE FLORIDA, REPERCUSIONES.

viernes, 19 de mayo de 2023

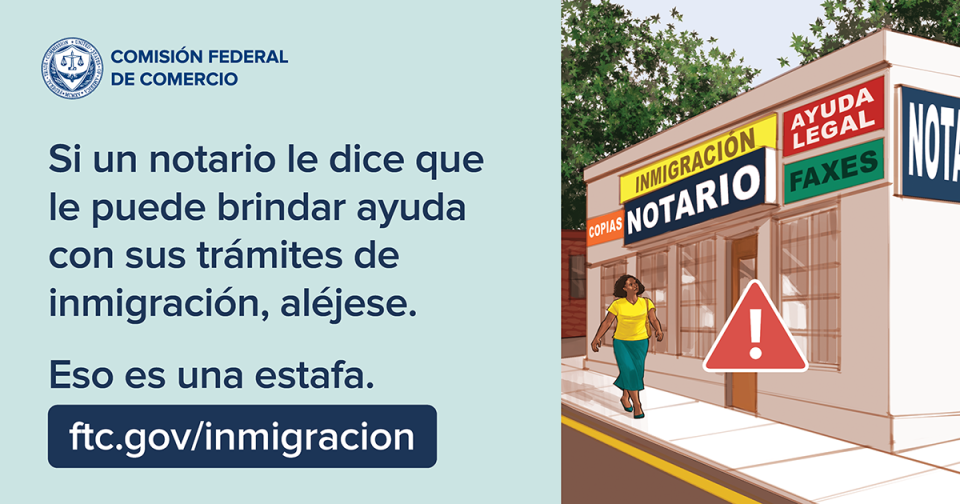

Cómo evitar las estafas dirigidas contra los inmigrantes.

Jennifer Leach

Cuando hay grandes cambios que generan confusión, los estafadores prosperan. Casi siempre. De modo que, como la semana pasada caducó el Título 42, la ley de la era de la pandemia relacionada con la inmigración, casi seguro que con el consiguiente “qué pasará después” los notarios tengan la esperanza de ganar dinero con esa pregunta. ¿Cómo detenerlos entonces?

Cuando hay grandes cambios que generan confusión, los estafadores prosperan. Casi siempre. De modo que, como la semana pasada caducó el Título 42, la ley de la era de la pandemia relacionada con la inmigración, casi seguro que con el consiguiente “qué pasará después” los notarios tengan la esperanza de ganar dinero con esa pregunta. ¿Cómo detenerlos entonces?jueves, 18 de mayo de 2023

USCIS Updates Review Process for the Processes for Cubans, Haitians, Nicaraguans, and Venezuelans

The U.S. government is granting advance travel authorization for up to 30,000 noncitizens each month to come to the United States to seek parole on a case-by-case basis under the processes for Cubans, Haitians, Nicaraguans, and Venezuelans. Due to high interest in these processes, USCIS is updating the review process effective May 17, 2023.

We are updating the review process because the number of supporters who have submitted Form I-134A, Online Request to be a Supporter and Declaration of Financial Support, is significantly higher than the 30,000 monthly travel authorizations available. It is intended to maintain a meaningful and equitable opportunity for all beneficiaries of a Form I-134A to move forward through the process and seek advance travel authorization.

Under the new review process that went into effect on May 17, USCIS will randomly select about half of the monthly total, regardless of filing date, from the entire pending workload of Form I-134A to determine whether the case can be confirmed. We will review the other half of the monthly total of Forms I-134A based on when the case was submitted under the first-in, first-out method, which prioritizes the oldest Forms I-134A for review.

Potential supporters should not submit a duplicate Form I-134A for the same beneficiary. We will not accept a duplicate Form I-134A if a previously submitted Form I-134A between the same potential supporter and beneficiary is pending. If we do not confirm a Form I-134A, but a supporter believes they meet the requirements to be a supporter under the process, they may file a new Form I-134A and submit additional information as evidence.

Under this updated review process, processing times will vary. Potential supporters may monitor the status of a Form I-134A they filed in their USCIS online account or check the most recent status in Case Status Online. The USCIS Contact Center cannot provide any additional information about the status of your case.

El gobierno de EE. UU. está otorgando autorización de viaje anticipada para hasta 30,000 no ciudadanos cada mes para que vengan a EE. UU. a solicitar la libertad condicional según cada caso según el procesos para cubanos, haitianos, nicaragüenses y venezolanos. Debido al gran interés en estos procesos, USCIS está actualizando el proceso de revisión a partir del 17 de mayo de 2023. Estamos actualizando el proceso de revisión porque la cantidad de seguidores que han enviado El Formulario I-134A, Solicitud en línea para ser patrocinador y Declaración de apoyo financiero , es significativamente más alto que las 30,000 autorizaciones de viaje mensuales disponibles. Su objetivo es mantener una oportunidad significativa y equitativa para que todos los beneficiarios de un Formulario I-134A avancen en el proceso y busquen una autorización de viaje anticipada. Según el nuevo proceso de revisión que entró en vigencia el 17 de mayo, USCIS seleccionará al azar aproximadamente la mitad del total mensual, independientemente de la fecha de presentación, de toda la carga de trabajo pendiente del Formulario I-134A para determinar si se puede confirmar el caso. Revisaremos la otra mitad del total mensual de los Formularios I-134A en función de cuándo se presentó el caso según el método de primeras entradas, primeras salidas, que prioriza los Formularios I-134A más antiguos para su revisión. Los patrocinadores potenciales no deben presentar un Formulario I-134A duplicado para el mismo beneficiario. No aceptaremos un Formulario I-134A duplicado si está pendiente un Formulario I-134A presentado anteriormente entre el mismo patrocinador potencial y el beneficiario. Si no confirmamos un Formulario I-134A, pero un partidario cree que cumple con los requisitos para ser un partidario según el proceso, puede presentar un nuevo Formulario I-134A y enviar información adicional como evidencia. Bajo este proceso de revisión actualizado, los tiempos de procesamiento variarán. Los partidarios potenciales pueden controlar el estado de un Formulario I-134A que presentaron en su Cuenta en línea de USCIS o comprobar el estado más reciente en Estado del caso en línea . El Centro de contacto de USCIS no puede proporcionar ninguna información adicional sobre el estado de su caso. |

Te ayudamos y acompañamos a realizar tu sueno en los Estados Unidos. Te abrimos tu empresa.

Te ayudamos y acompañamos a realizar tu sueno en los Estados Unidos. Te abrimos tu empresa.

Your Miami Beach Memorial Day Weekend checklist!

|

¿Qué Montos de Propinas (“Tips”) Califican para Reporte al IRS?

1. ¿Qué Montos de Propinas (“Tips”) Califican para Reporte al IRS? Todas las propinas que recibe un empleado deben reportarse al emplead...

-

Necesitas abrir una empresa en los Estados Unidos de America, sin importar en que país te encuentras, necesitas facturar, cobrar, depositar ...

-

Presente y pague para limitar multas e intereses Aun cuando un contribuyente no pueda pagar su saldo de impuestos adeudados de inmediato, to...

-

“Comienza 2026 con Orden Financiero: Por Qué Ahora Más que Nunca Necesitas Contabilidad Profesional”En los Estados Unidos, y especialmente en Florida, estamos viviendo uno de los momentos más cambiantes en materia tributaria, corporativa ...

-

ESTA ES UNA INFORMACION COMPARTIDA DE NUESTRO OTRO BLOG DE LATIN PEOPLE NEWS Y DE TWO HUNDRED GLOBAL FINANCIAL SOLUTIONS, ES A MANERA INFORM...

-

La Importancia de un Planificador Financiero y Tributario Permanente vs. Un Servicio Anual En el mundo empresarial y personal, la contabi...

-

Impuestos Personales en Estados Unidos: Por Qué Hoy Más Que Nunca Debes Estar Preparado En Estados Unidos, la preparación de impuestos per...

-

Corporate Transparency Act’s Reporting Obligations Revived February 19, 2025 Once again, Beneficial Ownership Information (BOI) reporting ...

-

Último día del 2025: cierre de un año de cambios, desafíos y decisiones responsables Hoy nos encontramos a solo un día de despedir el año ...

-

Mensaje de Año Nuevo Al llegar al final de este año que hoy despedimos, no podemos ignorar que para muchas familias ha sido un camino difí...

-

Navidad: cuando la perseverancia se convierte en esperanza En esta época de Navidad, desde Two Hundred Global Financial Solutions , quer...

.jpg)

.jpg)