Somos la solución integral a su empresa y hacemos realidad sus proyectos dentro de los Estados Unidos. www.200gfs.com Two Hundred Global Financial Solutions es: Contabilidad, Taxes, Nuevas Empresas, EIN, ITIN, Registro de Marca Comercial, Notaria Publica, Informes Económicos y Proyectos, Real Estate y mucho mas..Oficinas en Florida USA. Artículos en Español y en Ingles. News in English and Spanish.

domingo, 17 de marzo de 2024

1031 Exchange por 200GFS

jueves, 14 de marzo de 2024

Maneras seguras de detectar a un estafador

Los estafadores dicen y hacen cosas que nos pueden indicar que están mintiendo y que no son quienes fingen ser. Por supuesto que para escuchar o ver esas pistas, tenemos que superar el pánico que nos hacen sentir los estafadores, gracias a las supuestas emergencias que intentan crear. Y como los estafadores son convincentes, eso también puede ser difícil de lograr. Pero las estafas más recientes le están costando a la gente los ahorros de toda una vida, y es por eso que aquí te listamos algunas maneras seguras de detectar al estafador.

Cosas que sólo dicen los estafadores:

- “¡Actúe ya!” Eso es una estafa. Los estafadores te presionan para que no tengas tiempo de pensar. Pero la presión para actuar en el acto siempre es un signo de una estafa. Y también es un motivo para pisar el freno.

- “Sólo diga lo que yo le diga que diga”. Eso es una estafa. En el mismo minuto que alguien te diga que le mientas a otros, incluidos los cajeros del banco o los agentes de inversiones, pisa el freno. Es una estafa.

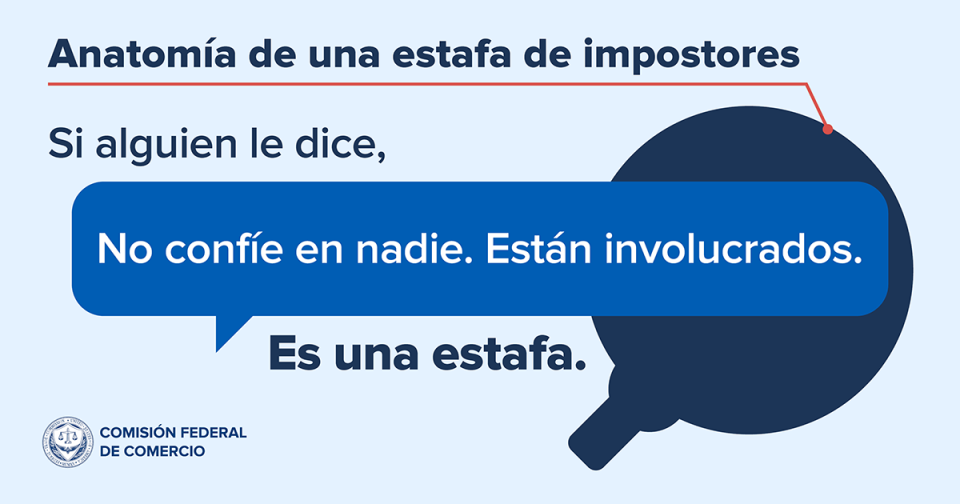

- “No confíe en nadie. Ellos están involucrados”. Eso es una estafa. Los estafadores quieren aislarte de cualquier persona que pueda frenarte.

- “Haga [esto] o lo arrestarán”. Eso es una estafa. Cualquier amenaza como ésta es una mentira. Nadie necesita que le entregues dinero o información para mantenerte fuera de la cárcel, impedir que te deporten o evitar multas más altas. Son todas estafas.

- “No cuelgue el teléfono”. Esa es una estafa. Si alguien quiere que permanezcas al teléfono mientras tú retiras o transfieres dinero, compras tarjetas de regalo o cualquier otra cosa que te pida que hagas: es un estafador. CUELGA el teléfono.

También te brindamos una lista de las cosas que únicamente los estafadores te dirán que hagas:

- “Mueva su dinero para protegerlo” es una estafa. Nadie que actúe legítimamente te dirá que transfieras o retires dinero de tus cuentas bancarias o de inversión. Pero los estafadores sí lo harán.

- “Retire dinero y compre lingotes de oro” es una estafa. Siempre. En toda ocasión.

- “Retire dinero y entrégueselo a [cualquiera]” es una estafa. Digan lo que digan: es una estafa. No se lo des a un mensajero, no lo entregues en ninguna parte, ni lo envíes. Es una estafa.

- “Vaya a un cajero ATM de Bitcoin” es una estafa. Nadie que actúe legítimamente te insistirá jamás para que obtengas criptomonedas de ninguna clase. Y no hay ninguna razón legítima para que alguien te mande a un cajero ATM de Bitcoin. Es una estafa.

- “Compre tarjetas de regalo” es una estafa. Nunca hay ningún motivo para pagar algo con una tarjeta de regalo. Y una vez que compartes los números de PIN que están al dorso de la tarjeta, tu dinero desaparece.

Si ves o escuchas cualquier versión de estas frases, acabas de detectar a un estafador. En lugar de hacer lo que dicen que hagas, pisa el freno. Cuelga el teléfono. Elimina el email. Deja de intercambiar mensajes de texto. Bloquea su número, haz lo que sea para alejarte del estafador. Y luego, cuéntaselo a alguien de tu confianza y reporta la estafa a la FTC en ReporteFraude.ftc.gov.

Imagen

Nuestra serie de blogs "Anatomía de una estafa de impostores" explica cómo reconocer, evitar y denunciar a los estafadores que se hacen pasar por un negocio o por el gobierno. Lee más.

- Nunca muevas tu dinero para “protegerlo”. Eso es una estafa

- ¿Qué es un código de verificación y por qué me lo pediría alguien?

- ¿Tu banco o fondo de inversión detendrá una transferencia a un estafador? Probablemente no

- Maneras seguras de detectar a un estafador

- ¿Recibiste una llamada o mensaje de texto sobre una compra sospechosa en Amazon? Es una estafa

- Nuevos estafadores de soporte técnico que quieren quedarse con los ahorros de toda tu vida

- ¿Alguien te mandó a un cajero ATM de Bitcoin? Es una estafa FTC

Labels:

#beach#fincen #llc #corp #taxes #IRS #200gfs #juanfanti #cta #love #instagram #instagood #followme #usa #miami #florida #usa,

#ESTFAS

Auto dealers must register with the IRS to receive advance payments of the Clean Vehicle Tax Credit

Auto dealers must register with the IRS to receive advance payments of the Clean Vehicle Tax Credit

To submit time-of-sale reports and receive advance payments of the Clean Vehicle Tax Credit, auto dealers and sellers must register their business with IRS Energy Credits Online. Dealers and sellers must use this tool to submit all time-of-sale reports for vehicles placed in service in 2024 and future years.

How to register

To register or access a previously registered business, dealers and sellers can go to IRS Energy Credits Online. The step-by-step instructions guide them through the process to register, submit time-of-sale reports and enter advance payment information. It may take 15 days or longer for the registration to process.

Once registered, dealers and sellers must use this tool to enter time-of-sale reports and provide the buyer certain required information.

What happens after registration

When a dealer successfully submits a time-of-sale report, the vehicle is eligible for the credit. A submission is successful when the dealer receives a copy of the report and a confirmation of acceptance by IRS Energy Credits Online. Buyers should use the copy of the report when they file their annual federal tax return.

Find out more about the Clean Vehicle Credits at IRS.gov/cleanvehicle.

miércoles, 13 de marzo de 2024

TAX DEADLINE APPROACHING

As the season progresses, it is important to understand the IRS due deadlines. Not meeting the deadlines can lead to major difficulties depending on the nature of the violation. Here we list several deadlines you should be aware of for your financial planning.

For Personal Tax Returns for the year 2023, the due date is April 15, 2024. This applies to paying IRS dues or any request for an extension.

For citizens of Maine, due to federal holidays, their due date will be moved to April 17, 2024.

For people in a federally declared disaster area, extensions may vary area to area, so go to the IRS website to find out whether are located in a disaster area and whether the deadline has been pushed.

If the need arises, an extension may be requested for filling your tax return. The extension will push the deadline to the 15th of October.

Works Cited

https://www.irs.gov/newsroom/2024-tax-filing-season-set-for-january-29-irs-continues-to-make-improvements-to-help-taxpayers

https://www.irs.gov/newsroom/tax-relief-in-disaster-situations

CONTACT US/LLÁMANOS:

WhatsApp: +1 (954) 261-2280 or Telegram

For English communications: workacc200gfs@

For Spanish communications: info@200gfs.com

Labels:

@200GFS,

@itcnova,

#200GFS,

#200gfs #juanfanti,

#accounting,

#cta,

#dinero,

#finances,

#instagram #instagood,

#irs,

#itin,

#money,

#Prepping,

#taxes,

#taxplanning

Location: Florida, USA

Florida, USA

martes, 12 de marzo de 2024

BEWARE OF MEDICAL EXPENSE MISREPRESENTATION

The IRS has reported concerns over the common interpretation regarding the difference between medical expenses and their relation to deductions or reimbursements. Personal expenses for general health and wellness do not count as medical expenses for IRS purposes. However, due to similarities, many individuals and even companies have made the error of conflating the two.

This is important for personal and organizational purposes. For individuals, they may be tempted to write up certain wellness products as reimbursements. For companies, they may mistakenly belief, or falsely claim, that self-reporting may be all that is needed to make expenses which are not specifically targeted for the purposes of a diagnosis, might be a medical expense under tax law.

When people confuse the definition of medical expense under tax law, they are at risk of either being exploited or becoming disadvantaged. Because of this it is crucial to be well-informed when it comes to any issue regarding the law. The IRS provides many resources from which you can learn about the technicalities of tax code. In addition, we at 200GFS are always open to do a consultation about IRS regulations and obligations. Call us today and we will make sure you know everything you need to know to wring out the most of Spring.

Works Cited

https://www.irs.gov/newsroom/irs-alert-beware-of-companies-misrepresenting-nutrition-wellness-and-general-health-expenses-as-medical-care-for-fsas-hsas-hras-and-msas

CONTACT US/LLÁMANOS:

WhatsApp: +1 (954) 261-2280 or Telegram

For English communications: workacc200gfs@

For Spanish communications: info@200gfs.com

Labels:

@200GFS,

@itcnova,

#200GFS,

#200gfs #juanfanti,

#accounting,

#cta,

#dinero,

#finances,

#instagram #instagood,

#irs,

#itin,

#money,

#Prepping,

#taxes,

#taxplanning

Location: Florida, USA

Florida, USA

lunes, 11 de marzo de 2024

SPRING IS TAX SEASON, CALL NOW

CONTACT US/LLÁMANOS:

WhatsApp: +1 (954) 261-2280 or Telegram

For English communications: workacc200gfs@

For Spanish communications: info@200gfs.com

Labels:

@200GFS,

@itcnova,

#200GFS,

#200gfs #juanfanti,

#accounting,

#cta,

#dinero,

#finances,

#instagram #instagood,

#irs,

#itin,

#money,

#Prepping,

#taxes,

#taxplanning

Location: Florida, USA

Florida, USA

lunes, 4 de marzo de 2024

BE READY THIS EASTER/ ESTE LISTO PASCUA

With Easter coming up, be sure that you have everything ready for the up coming tax season. Don't let the holiday be bogged down by thinking of taxes. Call us now at the information below.

Con la Semana Santa por la esquina, asegúrese de tener todo preparado para la próxima temporada de impuestos. No deje que el día festivo se empantanen pensando acerca de impuestos. Llámenos ahora a la información de abajo.

CONTACT US/LLÁMANOS:

WhatsApp: +1 (954) 261-2280 or Telegram

For English communications: workacc200gfs@

For Spanish communications: info@200gfs.com

Labels:

@200GFS,

@itcnova,

#200GFS,

#200gfs #juanfanti,

#accounting,

#cta,

#dinero,

#finances,

#instagram #instagood,

#irs,

#itin,

#money,

#Prepping,

#taxes,

#taxplanning

Location: Florida, USA

Florida, USA

viernes, 1 de marzo de 2024

IMPUESTOS CORPORATIVOS - CORPORATE TAXES IN USA

Quedan apenas 15 días para estar al día con los impuestos de su empresa en los Estados Unidos de América, no deje que el IRS le imponga una penalidad por no estar a tiempo, sino tiene su contabilidad al día o no ha hecho sus impuestos este es el momento que corra a hacer una cita con nosotros lo antes posible.

Nosotros lo ayudamos de la forma correcta y legal, no todo lo que ve en las redes o escucha de conocidos con correctas o legales no caiga en esas trampas comprando un grave problema para su futuro y él de su familia.

Two Hundred Global Financial Solutions (200GFS)

jueves, 29 de febrero de 2024

LATIN PEOPLE NEWS: Los pagos a través de tarjetas internacionales en ...

LATIN PEOPLE NEWS: Los pagos a través de tarjetas internacionales en ...: ntn24ve Los pagos a través de tarjetas internacionales en Venezuela quedan exonerados del Impuesto a las Grandes Transacciones Financieras (...

lunes, 26 de febrero de 2024

LATIN PEOPLE NEWS: Adjustment to Premium Processing Fees Takes Effect...

LATIN PEOPLE NEWS: Adjustment to Premium Processing Fees Takes Effect...: Como se anunció anteriormente, las nuevas tarifas de procesamiento premium ajustadas a la inflación del Servicio de Ciudadanía e Inmigraci...

100 years of wisdom: Two World War II Veteran centenarians

Two World War II Veteran centenarians celebrating their 100th and 101st birthdays have seen drastic changes in the world.

Veterans James W. Smith and Alexander E. Vroblesky have experienced many changes in their lifetime with help from the VA Maryland Health Care System.

“Without Maryland VA, my dad would probably be in a nursing home and he might not still be alive,” said Ginny Vroblesky, his daughter and caregiver. “His primary care doctor has advised and provided the necessary supplies to enable me to take care of him. We were able to get a wheelchair accessible van because of his combat related injuries.”

Audrey Smith, James W. Smith’s daughter, echoes the sentiment. “From the emergency room staff to various specialty personnel and the inpatient hospital staff, all have worked together to focus on the right care plan for his specific needs. Anything he needed, for example to hear better, has been provided. A stair lift is on the way.”

“The focus is to maintain a good quality of life.”

“These oldest patients can have medically complex issues,” said Dr. Saeeduddin Khan, of the GeriPACT team who serves the older patients. “Our goal is to do what is best for the Veterans’ wellbeing. The focus is to maintain a good quality of life as long as possible.”

This means not relying on a plethora of medicines that could bring about unwelcomed side effects. “Every medicine has side effects. Sometimes by giving medicines to patients at this age to solve one problem, it creates a series of other problems due to the side effects,” Khan added.

Born in Oxford, North Carolina, the oldest of eight children, Rev. James W. Smith, who turned 100 Nov. 6, 2023, grew up on a farm before being drafted into the Army the first time in 1944, and the second time in 1947. He worked in food service as a dietitian and cook.

He married Mary Alice Royster in 1950, and they had two daughters, Belendia and Audrey. “As a result of my service, I was able to gain access to education, health care and other services that improved my life and that of my family. I’ve been coming to VA since my first discharge in 1946 in North Carolina and later Maryland,” Smith said.

Smith credits all his success to his relationship with God and heeding the call to enter the ministry. He organized the Little Antioch Baptist Church in Baltimore which later become Second Antioch Baptist Church where he served as pastor for 42 years.

“I want people to see the importance of having a good relationship with God first, then your family and friends and those you with work with. Then you will have a happy life because of all your positive relationships.” He preached the day before his 100th birthday.

“She was interested in a fire truck and I was interested in her.”

Alexander E. Vroblesky (pictured above with his family) celebrated his 101st birthday Oct. 19, 2023. Born in Highland, Pennsylvania, he worked as a riveter in Baltimore. He met the young woman who would become his wife, Virginia Walker, when he saw a fire truck followed by a beautiful woman. “She was chasing the fire truck because she came from a small town in West Virginia and had never seen a fire truck before. She was interested in the truck, and I was interested in her.”

Vroblesky enlisted in the Army in 1942 and was accepted into Air Cadet training to become a pilot. He became a member of the 15th Air Force, 485th Bomb Group, 829th Bomb Squadron, stationed in Italy.

As a co-pilot of a B-24 bombing mission, his plane became disabled, causing the crew to bail out. “Most of us were captured and became POWs.” In Yugoslavia, while the prisoners were out of the train, the Chetniks came down from the hills and fought the Germans. The prisoners took off in all directions. The Bulgarians helped him rejoin the allies, but the prisoners were in tough shape and were taken for medical treatment.

Vroblesky returned to duty once he recovered. He spent 20 years in the Air Force as a training and personnel officer helping to shape the futures of young Airmen. His favorite assignment was as Commandant of the 313th Air Division Military Academy at Kadena, Okinawa.

After his discharge, he and Virginia stayed in Annapolis, where they raised their three children. They were married for 72 years, until her death at age 94 in 2017.

“The phrase ‘surely goodness and mercy shall follow me all the days of my life’ is appropriate for me,” he said, reflecting on his long life.

“Caring for our older Veterans, including those who have just turned 100, is a testament to our gratitude and respect for their service,” said Jona DeVera, coordinator for Outpatient Antimicrobial Therapy. “It’s an honor to serve them.”

Maryland VA offers specialized programs for eligible elderly Veterans. These services include home and community services, long-term care, fitness and rehabilitation, caregiver support, mental health, memory loss and brain health, medical foster homes and many more innovative programs that promote health and wellness.

Labels:

#BOI #fincen #llc #corp #taxes #IRS #200gfs #juanfanti #cta #love #instagram #instagood #followme #usa #miami #florida #usa,

#veterans

miércoles, 21 de febrero de 2024

THE TIME IS APPROACHING/ EL TIEMPO SE ACERCA

The time is approaching. IRS filing in the US is every April, which leaves little time for most people. Call us today and keep ahead of the curve. Don't let yourself be left behind. Be ready for when the filing date is due.

Se acerca el tiempo. La declaración de la renta en EE.UU. es cada abril, lo que deja poco tiempo a la mayoría de la gente. Llámanos hoy mismo y adelántese a los acontecimientos. No se quede atrás. Esté preparado para cuando llegue la fecha de presentación.

CONTACT US/LLÁMANOS:

WhatsApp: +1 (954) 261-2280 or Telegram

For English communications: workacc200gfs@

For Spanish communications: info@200gfs.com

Labels:

@200GFS,

@itcnova,

#200GFS,

#200gfs #juanfanti,

#accounting,

#cta,

#dinero,

#finances,

#instagram #instagood,

#irs,

#itin,

#money,

#Prepping,

#taxes,

#taxplanning

Location: Florida, USA

Florida, USA

martes, 20 de febrero de 2024

200GFS, FOR ALL YOUR TAX NEEDS

200GFS is a company that does taxes. And that means everything from filling and accounting your returns, to planning and strategizing how to organize your finances. We will make sure you are not just filing your forms, but also that you are optimizing what you can get out of your income. Call today and make an appointment with us with the information. Call and we will give you whatever financial services you may need.

CONTACT US/LLÁMANOS:

WhatsApp: +1 (954) 261-2280 or Telegram

For English communications: workacc200gfs@

For Spanish communications: info@200gfs.com

Labels:

@200GFS,

@itcnova,

#200GFS,

#200gfs #juanfanti,

#accounting,

#cta,

#dinero,

#finances,

#instagram #instagood,

#irs,

#itin,

#money,

#Prepping,

#taxes,

#taxplanning

Location: Florida, USA

Florida, USA

lunes, 19 de febrero de 2024

Suicide Prevention Conference call for abstracts. Veterans

Suicide Prevention Conference call for abstracts

Conference set for July 16-18 in Portland, Oregon

February 19, 2024

Suicide Prevention Conference Planning Team

The health and well-being of the nation’s service members and Veterans continues to be a top priority for VA and the U.S. Department of Defense (DoD). We are partnering again this year to host the 2024 VA/DoD Suicide Prevention Conference, the nation’s only conference dedicated to addressing military and Veteran suicide prevention.

The conference is scheduled to be held July 16–18 at the Oregon Convention Center in Portland.

Guided by the National Strategy for Preventing Veteran Suicide and Department of Defense Strategy for Suicide Prevention, VA and DoD care teams, leaders, allies and subject matter experts from across the country are invited to come together and share comprehensive and public health-based strategies to prevent suicide nationwide. Submit your abstract today.

Increasing the reach

This year’s theme—”Reimagining Suicide Prevention: Evolving and Innovating to Meet Diverse Needs”—focuses on innovative ways to reach at-risk service members and Veteran populations. This especially includes historically underserved and growing populations, such as Women, LGBTQ+, American Indian and Alaskan Native, and others.

We are seeking abstracts that address one or more of the following strategic directions:

- Increasing the knowledge of and ability to engage with current effective practices and evidence-based approaches to prevent suicide.

- Increasing awareness of clinical and community prevention, intervention and postvention strategies, tools and programs that will enhance equitable, and inclusive population access.

- Increasing the ability to promote innovative, sustainable strategies and interventions that meet the current and future needs of all Veterans, service members and those who support them.

Submit your abstract today

The due date for abstract submissions is March 4 at 11:59 p.m. ET. Go to the Conference Platform to submit your abstract.

Questions and contact

Look for more detailed conference information in the coming weeks. If you have any questions, email VADoDSuicidePreventionConf@va.gov.

- Learn more about the efforts of VA’s Office of Mental Health and Suicide Prevention and related resources.

- Learn more about DoD suicide prevention efforts and the Defense Suicide Prevention Office (DSPO).

If you or someone you know is having thoughts of suicide, contact the Veterans Crisis Line to receive free, confidential support and crisis intervention, available 24 hours a day, seven days a week, 365 days a year. Dial 988 then Press 1, text to 838255, or chat online at VeteransCrisisLine.net/Chat.

Labels:

#200GFS,

#beach#fincen #llc #corp #taxes #IRS #200gfs #juanfanti #cta #Spooky #instagram #instagood #followme #usa #miami #florida #itin,

#veterans

viernes, 16 de febrero de 2024

TIRED OF THE RUNABOUT?

When dealing with tax agencies, you can feel like you are going in circles, trying to understand how anything works. Call us now, and we will make sure you feel like you are making the best decisions possible.

CONTACT US/LLÁMANOS:

WhatsApp: +1 (954) 261-2280 or Telegram

For English communications: workacc200gfs@

For Spanish communications: info@200gfs.com

Labels:

@200GFS,

@itcnova,

#200GFS,

#200gfs #juanfanti,

#accounting,

#cta,

#dinero,

#finances,

#instagram #instagood,

#irs,

#itin,

#money,

#Prepping,

#taxes,

#taxplanning

Location: Florida, USA

Florida, USA

jueves, 15 de febrero de 2024

MAKE AN APPOINTMENT TODAY

Make an appointment with us today and be ready when the government comes knocking on your door. Call us by using the information below.

CONTACT US/LLÁMANOS:

WhatsApp: +1 (954) 261-2280 or Telegram

For English communications: workacc200gfs@

For Spanish communications: info@200gfs.com

Labels:

@200GFS,

@itcnova,

#200GFS,

#200gfs #juanfanti,

#accounting,

#cta,

#dinero,

#finances,

#instagram #instagood,

#irs,

#itin,

#money,

#Prepping,

#taxes,

#taxplanning

Location: Florida, USA

Florida, USA

miércoles, 14 de febrero de 2024

FILE TODAY WITH 200GFS/ ARCHIVA HOY CON 200GFS

Don't get bogged down by confusing legalese, let the professionals take care of it. 200GFS specializes in tax accounting. You can trust us with whatever tax related concerns you may have. Call us today and we will cut through the jumble.

No se quede atorado en trámites legales confusos, dejaselo a los profesionales. 200GFS se especializa en contabilidad e impuestos. Puede confiar en nosotros para cualquier asunto relacionado con los impuestos que pueda tener. Llámenos hoy mismo y le ayudaremos a salir del embrollo.

CONTACT US/LLÁMANOS:

WhatsApp: +1 (954) 261-2280 or Telegram

For English communications: workacc200gfs@

For Spanish communications: info@200gfs.com

Labels:

@200GFS,

@itcnova,

#200GFS,

#200gfs #juanfanti,

#accounting,

#cta,

#dinero,

#finances,

#instagram #instagood,

#irs,

#itin,

#money,

#Prepping,

#taxes,

#taxplanning

Location: Florida, USA

Florida, USA

FinCEN Sees Increase in BSA Reporting Involving the Use of Convertible Virtual Currency for Online Child Sexual Exploitation and Human Trafficking

FinCEN Sees Increase in BSA Reporting Involving the Use of Convertible Virtual Currency for Online Child Sexual Exploitation and Human Trafficking

The U.S. Department of the Treasury’s Financial Crimes Enforcement Network (FinCEN) issued a Financial Trend Analysis (FTA) today reflecting an increase in Bank Secrecy Act (BSA) reporting associated with the use of convertible virtual currency and online child sexual exploitation and human trafficking. This FTA is based on BSA reporting filed between January 2020 and December 2021.

News Release: https://www.fincen.gov/news/

Financial Trend Analysis: https://www.fincen.gov/sites/

Labels:

#BOI #fincen #llc #corp #taxes #IRS #200gfs #juanfanti #cta #love #instagram #instagood #followme #usa #miami #florida #usa,

#fincen

martes, 13 de febrero de 2024

IRS WARNINGS AGAINST SCAMS/EL IRS ADVIERTE CONTRA ESTAFAS

IRS warns tax professionals to be aware of EFIN scam email

In a recent security submit, the IRS has presented the threat of scam emails directed to steal the EFINs of several software companies. They pose as tax software providers to gain access to client data to file for fraudulent tax returns for refunds.

The IRS has proceeded to make several webinars that will teach you anything you may need to know about these scams. They begin Feb. 12 and will continue throughout the the week.

Signs you can use to spot a fake include: a means from which EFIN documents may be sent or faxed to an area code, instructions on how to get EFIN information online, or even multiple fax numbers for the same vendor. Do not respond to these emails, and most certainly do not follow their instructions.

This post is heavily based on an article by the IRS. Use the link below to get more information on tax scams and to join available webinars on the very subject.

https://www.irs.gov/newsroom/irs-warns-tax-professionals-to-be-aware-of-efin-scam-email-special-webinars-offered-next-week

CONTACT US/LLÁMANOS:

WhatsApp: +1 (954) 261-2280 or Telegram

For English communications: workacc200gfs@

For Spanish communications: info@200gfs.com

Labels:

@200GFS,

@itcnova,

#200GFS,

#200gfs #juanfanti,

#accounting,

#cta,

#dinero,

#finances,

#instagram #instagood,

#irs,

#itin,

#money,

#Prepping,

#taxes,

#taxplanning

Location: Florida, USA

Florida, USA

lunes, 12 de febrero de 2024

MARK A DATE TODAY/ MARCA UNA FECHA

200GFS specializes in taxes. Whether it is filling a 1040, or planning your financial strategy, we got you. We will make sure you have everything you need for April. Call now, and we'll show you what we can do.

200GFS se especializa en impuestos. Ya sea llenando un 1040, o la planificación de su estrategia financiera, te tenemos. Nos aseguraremos de que tenga todo lo que necesites para abril. Llame ahora, y verás lo que podemos hacer.

CONTACT US/LLÁMANOS:

WhatsApp: +1 (954) 261-2280 or Telegram

For English communications: workacc200gfs@

For Spanish communications: info@200gfs.com

Labels:

@200GFS,

@itcnova,

#200GFS,

#200gfs #juanfanti,

#accounting,

#cta,

#dinero,

#finances,

#instagram #instagood,

#irs,

#itin,

#money,

#Prepping,

#taxes,

#taxplanning

Location: Florida, USA

Florida, USA

viernes, 9 de febrero de 2024

FIND OUT WHAT YOU OWE TODAY/ AVERIGUA LO QUE DEBES HOY

The IRS knows how much you owe. Find out today, with 200GFS. We will tell you everything about your tax obligations, and we will answer any question you may have about your tax return. Call now with the details below and get started.

El IRS sabe cuánto debes. Averigúelo hoy, con 200GFS. Le diremos todo sobre sus obligaciones fiscales y responderemos cualquier pregunta que pueda tener sobre su declaración de la renta. Llame con los datos que le indicamos a continuación y empiece ahora.

CONTACT US/LLÁMANOS:

WhatsApp: +1 (954) 261-2280 or Telegram

For English communications: workacc200gfs@

For Spanish communications: info@200gfs.com

Labels:

@200GFS,

@itcnova,

#200GFS,

#200gfs #juanfanti,

#accounting,

#cta,

#dinero,

#finances,

#instagram #instagood,

#irs,

#itin,

#money,

#Prepping,

#taxes,

#taxplanning

Location: Florida, USA

Florida, USA

jueves, 8 de febrero de 2024

Two Hundred Global Financial Solutions, te invita a visitar a Latin People News

200GFS, te invita a visitar y suscribirte a Latin People News, blog de nuestro grupo para mantenerte también informado del acontecer mundial y en especial noticias de interés para los latinos que viven en los Estados Unidos de America a traves:

https://latinpeoplesnews.blogspot.com/

Labels:

#200GFS,

#boi,

#ice,

#irs,

#juanfanti,

#latin,

#latinpeoplenews,

#miami,

#newyork,

#texas,

#usa,

florida

THE CLOCK IS TICKING/ EL TIEMPO CORRE

Taxes in the US need to be presented by April. As time wounds down, be sure to be ready for when time runs out. Make an appointment today and get ahead of the clock, with 200GFS. We now have multiple packages for your specific needs, whether you are an individual or a business owner. Call for more information with the details below.

En los EE.UU., los impuestos deben ser presentados para abril. Mientras el tiempo pasa, asegúrese de estar preparado para cuando el tiempo se agote. Haz una cita hoy y adelántese al reloj, con 200GFS. Ahora disponemos múltiples paquetes para sus necesidades específicas, tanto si es usted un particular o empresario. Llama para obtener más información con los detalles debajo.

CONTACT US/LLÁMANOS:

WhatsApp: +1 (954) 261-2280 or Telegram

For English communications: workacc200gfs@

For Spanish communications: info@200gfs.com

Labels:

@200GFS,

@itcnova,

#200GFS,

#200gfs #juanfanti,

#accounting,

#cta,

#dinero,

#finances,

#instagram #instagood,

#irs,

#itin,

#money,

#Prepping,

#taxes,

#taxplanning

Location: Florida, USA

Florida, USA

LATIN PEOPLE NEWS: U.S. Department of Homeland Security Daily Digest ...

LATIN PEOPLE NEWS: U.S. Department of Homeland Security Daily Digest ...: La campaña azul del DHS se asocia con Lyft para educar a los conductores de viajes compartidos sobre cómo detectar y prevenir la trata de pe...

miércoles, 7 de febrero de 2024

Honoring Veterans: Marine Corps Veteran Purcell Johnson

This week’s Honoring Veterans Spotlight honors the service of Marine Corps Veteran Purcell Johnson, who served during WWII from 1943 to 1946.

Johnson was from Dahlgren, Virginia. Many of his family members have military backgrounds, including his sister, Romay Davis, and his brother, Stan Johnson, who both received a Congressional Gold Medal.

Johnson registered for Selective Service in 1942, working at the Dahlgren Navy Yard before finally enlisting in the Class III Volunteer Marine Corps Reserve in October 1943. Along with his younger brother, he eventually became a Marine at Montford Point Camp in Jacksonville, North Carolina.

Johnson served in the 7th Separate Infantry Battalion and then ultimately transferred to the 29th Marine Depot Company in July 1944 when he was promoted to corporal. He was stationed at Banika Island, where his unit provided logistical support to other Marine units. He later relocated to Guam in Marianas Island, where he earned his sergeant stripes in July 1945. In January 1946, he became an MP.

Johnson returned to the states and was honorably discharged. He served three years in the Marine Corps Reserve, including two of those years overseas. He was celebrated as an aircraft mechanic with Trans World Airlines in his post-military career.

Johnson died April 2002. He was 78. In January 2024, his sister, Pvt. Romay Johnson Davis, received his posthumous bronze replica of the Congressional Gold Medal during a ceremony in Montgomery on his behalf, making him the third sibling with this medal.

We honor his service.

Nominate a Veteran

Do you want to light up the face of a special Veteran? Have you been wondering how to tell your Veteran they are special to you? VA’s “Honoring Veterans” social media spotlight is an opportunity to highlight your Veteran and his/her service.

It’s easy to nominate a Veteran. Visit our blog post about nominating to learn how to create the best submission.

Writer: Trinity Green

Editor: Tayler Rairigh

Researcher: Raphael Romea

Graphic Designer: Kiki Kelley

martes, 6 de febrero de 2024

U.S. Department of Homeland Security Daily Digest Bulletin (Boletín de resumen diario del Departamento de Seguridad Nacional de EE. UU.)

|

Labels:

#homelandsecurity,

#ice,

#irs

Suscribirse a:

Entradas (Atom)

¿Qué necesitas para abrir tu empresa en Estados Unidos? ¡Nosotros te lo explicamos!

¿Qué necesitas para abrir tu empresa en Estados Unidos? ¡Nosotros te lo explicamos! En Two Hundred Global Financial Solution, te guiamos...

-

CFPB takes action against Bank of America for illegally charging junk fees, withholding credit card rewards, and opening fake accounts Tod...

-

Revocación automática del estado de exención por no presentación Los formularios 990, 990-EZ, 990-N o 990-PF deben presentarse antes del d...

.png)

.jpg)