Para citas o preguntas: Presione Aqui

Somos la solución integral a su empresa y hacemos realidad sus proyectos dentro de los Estados Unidos. www.200gfs.com Two Hundred Global Financial Solutions es: Contabilidad, Taxes, Nuevas Empresas, EIN, ITIN, Registro de Marca Comercial, Notaria Publica, Informes Económicos y Proyectos, Real Estate y mucho más. Oficinas en Florida USA. Artículos en Español y en Inglés. 12555 ORANGE DR., STE. 235, DAVIE, FL 33330, USA.

martes, 10 de diciembre de 2019

Su declaracion esta proxima

Labels:

Juan Fanti

Location: Florida, Davie, USA

Miami, Florida, EE. UU.

Te ayudamos y acompañamos a realizar tu sueno en los Estados Unidos. Te abrimos tu empresa.

Te ayudamos y acompañamos a realizar tu sueno en los Estados Unidos. Te abrimos tu empresa.

lunes, 18 de noviembre de 2019

Latin People News LPN: Nuevo folleto para influyentes de los medios socia...

Latin People News LPN: Nuevo folleto para influyentes de los medios socia...: 5 de noviembre de 2019 por Lesley Fair Abogada, División de educación del consumidor y negocios, FTC Es muy probable que conoz...

5 de noviembre de 2019

por

Lesley Fair

Abogada, División de educación del consumidor y negocios, FTC

Es muy probable que conozcas a un influyente, una persona que trabaja con una marca para recomendar o respaldar un producto en las redes sociales. Tal vez trabajes en una empresa que cuenta con personas influyentes o tal vez eres tú, un amigo o un familiar. Entonces, debes leer un nuevo folleto de la FTC: Divulgaciones 101 para influyentes de los medios sociales.

Los influyentes tienen la obligación de cumplir con la ley. Si endosa un producto o servicio a través de las redes sociales, su mensaje debe hacer evidente que usted tiene una relación (una “conexión relevante”) con la marca. Esto podría ser una relación personal, familiar o laboral o una relación financiera, por ejemplo, cuando una marca le paga o le ofrece productos gratuitos o con descuento.

La información sobre Divulgaciones 101 para influyentes de los medios sociales responde las preguntas que pueda tener acerca de cuándo divulgar, cómo divulgar y otras cosas que necesita saber. También explica que si no tiene una relación establecida con una marca y solo le está contando a la gente sobre un producto que compró y le gusta, no es necesario que diga que no tiene una relación con la marca. (El folleto está disponible en español y en inglés).

La FTC tiene otros recursos acerca de influyentes, endosos y revisiones de productos. También vea este nuevo video que explica algunas de las bases legales.

martes, 22 de octubre de 2019

Latin People News LPN: Aloe, adiós: las afirmaciones de la compañía no te...

Latin People News LPN: Aloe, adiós: las afirmaciones de la compañía no te...: 16 de octubre de 2019 por Bridget Small Especialista en educación del consumidor, FTC Es posible que hayas oído hablar del uso d...

martes, 20 de agosto de 2019

Que ofrecemos a nuestros clientes?: RR-2019-20: Applicable Federal Rates IRS

Que ofrecemos a nuestros clientes?: RR-2019-20: Applicable Federal Rates IRS: Issue Number: RR-2019-20 Inside This Issue Revenue Ruling 2019-20 provides various prescribed rates for federal income tax purpo...

Issue Number: RR-2019-20

Inside This Issue

Revenue Ruling 2019-20 provides various prescribed rates for federal income tax purposes including the applicable federal interest rates, the adjusted applicable federal interest rates, the adjusted federal long-term rate, the adjusted federal long-term tax-exempt rate. These rates are determined as prescribed by § 1274.

The rates are published monthly for purposes of sections 42, 382, 412, 642, 1288, 1274, 7520, 7872, and various other sections of the Internal Revenue Code.

Revenue Ruling 2019-20 will be in IRB: 2019-36, dated September 3, 2019.

Thank you for subscribing to IRS GuideWire, an IRS e-mail service. If you are a Tax Professional and have a specific concern about your tax situation, call the IRS Practitioner Priority Service 1-866-860-4259.

RR-2019-20: Applicable Federal Rates IRS

Issue Number: RR-2019-20

Inside This Issue

Revenue Ruling 2019-20 provides various prescribed rates for federal income tax purposes including the applicable federal interest rates, the adjusted applicable federal interest rates, the adjusted federal long-term rate, the adjusted federal long-term tax-exempt rate. These rates are determined as prescribed by § 1274.

The rates are published monthly for purposes of sections 42, 382, 412, 642, 1288, 1274, 7520, 7872, and various other sections of the Internal Revenue Code.

Revenue Ruling 2019-20 will be in IRB: 2019-36, dated September 3, 2019.

Thank you for subscribing to IRS GuideWire, an IRS e-mail service. If you are a Tax Professional and have a specific concern about your tax situation, call the IRS Practitioner Priority Service 1-866-860-4259.

Te ayudamos y acompañamos a realizar tu sueno en los Estados Unidos. Te abrimos tu empresa.

Te ayudamos y acompañamos a realizar tu sueno en los Estados Unidos. Te abrimos tu empresa.

How to Visualize Data for Your Area on data.census.gov

iles.

|

|

Te ayudamos y acompañamos a realizar tu sueno en los Estados Unidos. Te abrimos tu empresa.

Te ayudamos y acompañamos a realizar tu sueno en los Estados Unidos. Te abrimos tu empresa.

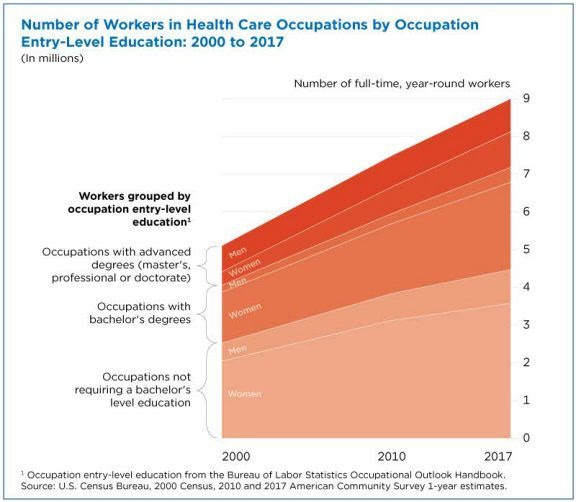

Your Health Care Is in Women’s Hands

America Counts: Stories Behind the Numbers Your Health Care Is in Women’s Hands

Women have driven 80% of the overall growth in the booming health care field since the turn of the century.

The number of full-time, year-round workers in health care occupations has almost doubled since 2000, increasing from 5 million to 9 million workers, according to the U.S. Census Bureau’s American Community Survey.

Women account for three-quarters of full-time, year-round health care workers today.

Read More

This rapid increase is expected to continue, as many health care occupations are projected to grow even faster than average.

About half of full-time, year-round health care workers have at least a college degree, and almost a quarter have an advanced degree. This often translates into earnings differences across occupations. Continue Reading...

| |

Help us spread the word about America Counts. Share this story on social media or forward it to a friend.

Share This | |

In Case You Missed It

Here are some more 2020 Census Address Canvassing Resources:

| |

About America Counts

America Counts tells the stories behind the numbers in a new inviting way. It features stories on various topics such as families, housing, employment, business, education, the economy, emergency preparedness, and population. Contact our Public Information Office for media inquiries or interviews.

|

Te ayudamos y acompañamos a realizar tu sueno en los Estados Unidos. Te abrimos tu empresa.

Te ayudamos y acompañamos a realizar tu sueno en los Estados Unidos. Te abrimos tu empresa.

IRS automatically waives estimated tax penalty for eligible 2018 tax filers

WASHINGTON — The Internal Revenue Service is automatically waiving the estimated tax penalty for the more than 400,000 eligible taxpayers who already filed their 2018 federal income tax returns but did not claim the waiver.

The IRS will apply this waiver to tax accounts of all eligible taxpayers, so there is no need to contact the IRS to apply for or request the waiver.

Earlier this year, the IRS lowered the usual 90% penalty threshold to 80% to help taxpayers whose withholding and estimated tax payments fell short of their total 2018 tax liability. The agency also removed the requirement that estimated tax payments be made in four equal installments, as long as they were all made by Jan. 15, 2019. The 90% threshold was initially lowered to 85% on Jan 16 and further lowered to 80% on March 22.

The automatic waiver applies to any individual taxpayer who paid at least 80% of their total tax liability through federal income tax withholding or quarterly estimated tax payments but did not claim the special waiver available to them when they filed their 2018 return earlier this year.

“The IRS is taking this step to help affected taxpayers,” said IRS Commissioner Chuck Rettig. “This waiver is designed to provide relief to any person who filed too early to take advantage of the waiver or was unaware of it when they filed.”

Refunds planned for eligible taxpayers who paid penalty

Over the next few months, the IRS will mail copies of notices CP 21 granting this relief to affected taxpayers. Any eligible taxpayer who already paid the penalty will also receive a refund check about three weeks after their CP21 notice regardless if they requested penalty relief. The agency emphasized that eligible taxpayers who have already filed a 2018 return do not need to request penalty relief, contact the IRS or take any other action to receive this relief.

For those yet to file, the IRS urges every eligible taxpayer to claim the waiver on their return. This includes those with tax-filing extensions due to run out on Oct. 15, 2019. The quickest and easiest way is to file electronically and take advantage of the waiver computation built into their tax software package. Those who choose to file on paper can fill out Form 2210 and attach it to their 2018 return. See the instructions to Form 2210 for details.

Because the U.S. tax system is pay-as-you-go, taxpayers are required by law to pay most of their tax obligation during the year, rather than at the end of the year. This can be done by having tax withheld from paychecks, pension payments or Social Security benefits, making estimated tax payments or a combination of these methods.

Like last year, the IRS urges everyone to do a “Paycheck Checkup” and review their withholding for 2019. This is especially important for anyone who faced an unexpected tax bill or a penalty when they filed this year. It’s also an important step for those who made withholding adjustments in 2018 or had a major life change. Those most at risk of having too little tax withheld include those who itemized in the past but now take the increased standard deduction, as well as two wage earner households, employees with nonwage sources of income and those with complex tax situations.

To get started, check out the new Tax Withholding Estimator, available on IRS.gov. More information about tax withholding and estimated tax can be found on the agency’s Pay As You Go web page, as well as in Publication 505.

Te ayudamos y acompañamos a realizar tu sueno en los Estados Unidos. Te abrimos tu empresa.

Te ayudamos y acompañamos a realizar tu sueno en los Estados Unidos. Te abrimos tu empresa.

IRS Revenue Ruling

| ||

|

News EssentialsIRS Resources | Issue Number: RR-2019-19Inside This Issue

Revenue Ruling 2019-19 provide that an individual receives a distribution check from a qualified plan and does not to cash the check. The revenue ruling concludes that the individual’s failure to cash the check does not permit the individual to exclude the amount of the designated distribution from gross income under § 402(a) and does not alter the employer’s withholding obligations under § 3405 or Form 1099-R reporting obligations under § 6047(d).

Revenue Ruling 2019-19 will be in IRB 2019-36, dated September 3, 2019.

|

Te ayudamos y acompañamos a realizar tu sueno en los Estados Unidos. Te abrimos tu empresa.

Te ayudamos y acompañamos a realizar tu sueno en los Estados Unidos. Te abrimos tu empresa.

Suscribirse a:

Comentarios (Atom)

FIRPTA 📌 Foreign Investment in Real Property Tax Act

FIRPTA en 2026: qué es, a quién afecta y por qué “no informar” puede convertirse en un problema serio Cuando un extranjero (foreign person...

-

Necesitas abrir una empresa en los Estados Unidos de America, sin importar en que país te encuentras, necesitas facturar, cobrar, depositar ...

-

Presente y pague para limitar multas e intereses Aun cuando un contribuyente no pueda pagar su saldo de impuestos adeudados de inmediato, to...

-

“Comienza 2026 con Orden Financiero: Por Qué Ahora Más que Nunca Necesitas Contabilidad Profesional”En los Estados Unidos, y especialmente en Florida, estamos viviendo uno de los momentos más cambiantes en materia tributaria, corporativa ...

-

La Importancia de un Planificador Financiero y Tributario Permanente vs. Un Servicio Anual En el mundo empresarial y personal, la contabi...

-

Impuestos Personales en Estados Unidos: Por Qué Hoy Más Que Nunca Debes Estar Preparado En Estados Unidos, la preparación de impuestos per...

-

Último día del 2025: cierre de un año de cambios, desafíos y decisiones responsables Hoy nos encontramos a solo un día de despedir el año ...

-

Mensaje de Año Nuevo Al llegar al final de este año que hoy despedimos, no podemos ignorar que para muchas familias ha sido un camino difí...

-

Navidad: cuando la perseverancia se convierte en esperanza En esta época de Navidad, desde Two Hundred Global Financial Solutions , quer...

-

⚖️ El dilema del financiamiento: ¿Quién gana y quién pierde? El país enfrenta otra vez el fantasma de un cierre de gobierno . La disputa ...

-

ESTA ES UNA INFORMACION COMPARTIDA DE NUESTRO OTRO BLOG DE LATIN PEOPLE NEWS Y DE TWO HUNDRED GLOBAL FINANCIAL SOLUTIONS, ES A MANERA INFORM...

.jpg)

.jpg)